The research tax credit (CIR)

Definition of the CIR and eligibility conditions

The Research and Development Tax Credit or CIR is the oldest and most important public fund for R&D French companies. The research tax credit applies to your basic research applied research and experimental development.

Your research and development project must therefore make it possible to acquire new knowledge and/or to experiment with your new products. The The ceiling of the CIR is equal to 30% of eligible expenses up to 100 million euros (and 5% beyond)). The eligible expenses of the CIR are :

- Depreciation charges (particularly patents) ;

- Staff costs (researchers and technicians),

- Operating costs,

- Expenses related to external research,

- Patent filing, defense and maintenance costs,

- Standardization expenses,

- Technology watch expenses.

Are you an industrial or technological company? AREAD helps you to benefit from the research tax credit, to secure the declaration through the scientific file that we write, and to renew it each year if your company still meets the eligibility criteria.

Get a free diagnosis on your eligibility for the CII within 48 hours:

Would you like to know our methodology and rates ?

In the event of hiring young doctors for their first permanent contract, the expenses eligible for the research tax credit can be taken into account at 200% in the calculation of the research tax credit. The official definition of the research tax credit can be found on the Bofip website or in the research tax credit guide published each year (discover the CIR 2022 guide).

To claim the research tax credit, your company must meet all the eligibility conditions related to the research and development project and the expenses incurred.

How to get the research tax credit (CIR) ?

To get the research tax credit, your company must prepare a supporting and scientific file for the Ministry of Research (MESR), calculate the CIR, declare the tax creditvia form 2069 form 2069 and follow the progress file (after validating your eligibility for this scheme). Completing a research tax credit file nevertheless requires specific skills.

AREAD, an expert consulting firm in research tax credit

Our experienced and specialized consultants help you get the Research Tax Credit with ease. We first estimate the eligibility of your company for the CIR, then we take care of your CIR file in full.

With more than 800 CIR missions carried out, most of which have been controlled by the tax services with 0.5% of sums adjusted for the last 4 years, our firm AREAD allows you to get this fund, to optimize it and to secure it.

Concerned about carrying out quality work for its clients, our team distinguishes itself on several points :

- Consultants experienced engineers or doctors; ;

- Face-to-face audit,

- Writing of scientific files,

- Assistance in the event of a tax audit.

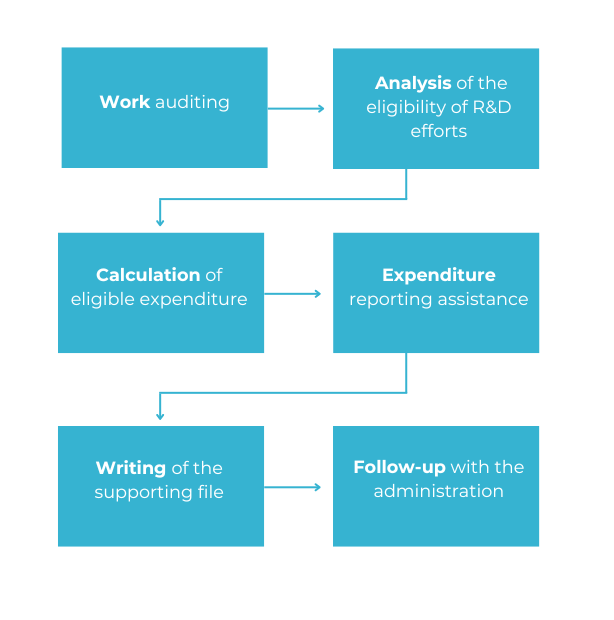

With a solid experience in the preparation of CIR files, we have a proven methodology and we know perfectly the expectations of the administration. Our support consists of 6 main steps:

As part of your CIR file, we can also take over your CIR approval :