Young Innovative Company (JEI) status (JEI)

Definition of JEI status and conditions

Is your company industrial or technological, less than 11 years old and carrying out R&D work ? Whether you are a young start-up or a SME, you can probably benefit from the JEI Status ! Contrary to its name, the Young Innovative Company status supports research and development work (fundamental research, applied research or experimental development). Thus, your work must allow the acquisition of new knowledge or the improvement of the state of the art. In this context, at least 15% of the expenses incurred by your young innovative company must relate to R&D.

Is your company industrial or technological, less than 11 years old and carrying out R&D work ? Whether you are a young start-up or a SME, you can probably benefit from the JEI Status ! Contrary to its name, the Young Innovative Company status supports research and development work (fundamental research, applied research or experimental development). Thus, your work must allow the acquisition of new knowledge or the improvement of the state of the art. In this context, at least 15% of the expenses incurred by your young innovative company must relate to R&D.

If you meet these eligibility conditions, you will be able to benefit fromexemptions on tax charges (corporate tax (IS), Annual Flat Tax, etc…) and thesocial charges (Urssaff employers' contributions) over a period of 11 years. from the creation of the company. Consequently, you reduce the cost of your employees assigned to R&D work. Beyond the advantages of the Young Innovative Company status, getting this aid makes it possible to secure your Research Tax Credit declaration. The Young Innovative Company status nevertheless commits you to maintaining your R&D activities over several years.

Several eligibility conditions must be taken into account. However, if these conditions are not respected for a year, this leads to the loss of JEI status. AREAD supports you in your application for Young Innovative Company status..

Get a free diagnosis of your eligibility for JEI status within 48 hours :

Would you like to know our methodology and our prices ?

How to get Young Innovative Company status ?

The Young Innovative Company status benefited 9,000 companies between 2004 and 2015 and this number continues to increase. Why not you ? To get Young Innovative Company status,your declaration will be taken into account by the Ministry of Finance on the one hand, and by URSAFF on the other. Despite the apparent simplicity of getting Young Innovative Company status, URSAFF can check your eligibility by auditing your research and development projects.

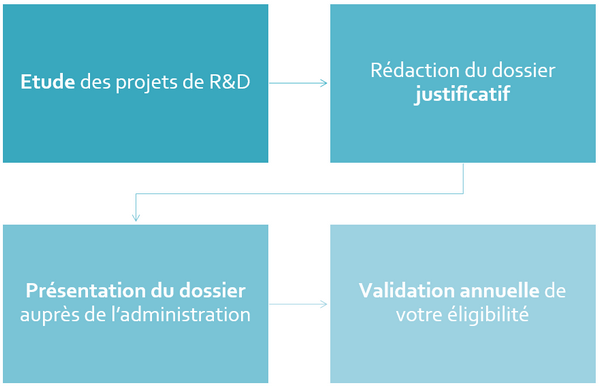

AREAD takes care of your JEI file to ensure that you get Young Innovative Company status. Our specialized consultants support you throughout the process :

Referenced as an expert in CIR and CII, our firm AREAD specializes in R&D funds.By choosing our services, you assure your company of getting this financing, its optimization and its security. The JEI status can also be combined with the CIR :

Are you planning an innovation project ? Discover the Innovation Tax Credit dedicated to SMEs.