The Innovation tax credit (CII)

Definition of the innovation tax credit (CII)

Thanks to the innovation tax credit, Frenchtechnological SMEs (ICT, industry, scientific and technical activities) can finance their expenses related to an innovation project. A product or a solution is innovative if it does not exist on the market. The amount of the innovation tax credit is set at 20% of eligible expenses (capped at €400,000) for grant of up to €80,000 per year and per company) Your company must carry out design activities for prototypes, new products and pilot installations. In this context, the expenses eligible for the innovation tax credit are personnel costs, depreciation allowances, patents, etc.

Thanks to the innovation tax credit, Frenchtechnological SMEs (ICT, industry, scientific and technical activities) can finance their expenses related to an innovation project. A product or a solution is innovative if it does not exist on the market. The amount of the innovation tax credit is set at 20% of eligible expenses (capped at €400,000) for grant of up to €80,000 per year and per company) Your company must carry out design activities for prototypes, new products and pilot installations. In this context, the expenses eligible for the innovation tax credit are personnel costs, depreciation allowances, patents, etc.

Identifying expenses eligible for the innovation tax credit (also called CIR innovation) requires specific skills. We bring you our scientific, accounting and tax expertise to optimize and secure your innovation tax credit. Thus, AREAD helps you to get this tax credit, and to renew it each year if your SME still meets the eligibility criteria.

Obtain a free diagnosis in 48 hours on your eligibility for the CII :

Would you like to know our methodology and our prices ?

How to get the Innovation Tax Credit (CII) ?

Our experienced and specialized consultants help you get the CII with ease. We first carry out an eligibility audit of your campany, then we manage your entire innovation tax credit file. We also support you in the event of a tax audit. Our firm AREAD allows you to get this grant, to optimize it and to secure it. To learn more about the Innovation Tax Credit. See our blog post.

Our firm is referenced as an expert in CIR CII.

This referencing guarantees our expertise, our transparency and the respect of virtuous practices with regard to our CIR CII services.

Concerned about carrying out quality work for its clients, our team distinguishes itself on several points :

- experienced Consultants engineers or doctors ;

- Face-to-face audit,

- Writing of scientific files,

- Assistance in the event of a tax audit.

The expenses of the CII can enter into the basis of calculation of the CIR. Therefore, we can also support your request for Research Tax Credit. If your company has existed for less than 8 years, you can also be eligible for Young Innovative Company status Dans As part of your Innovation Tax Credit file, we can also take care of your CII approval :

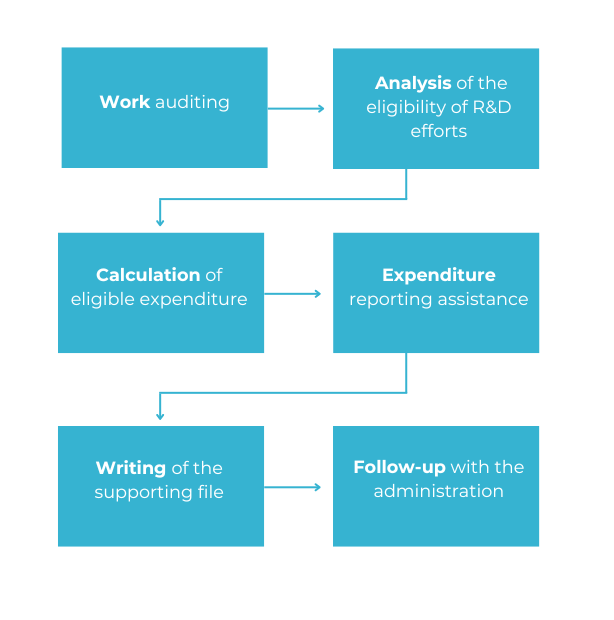

With solid experience in setting up Innovation Tax Credit files, we have a proven methodology and we are fully aware of the expectations of the administration. Our support consists of 6 main steps :